Container shipping lines are focusing on capacity management as rates plunge and shippers continue to reduce volume. Although the industry had expected market normalization at this time of the year, the changes have come about so suddenly it has forced container carriers to accelerate cuts in capacity by blanking sailing to slow the downward pressures on rates.

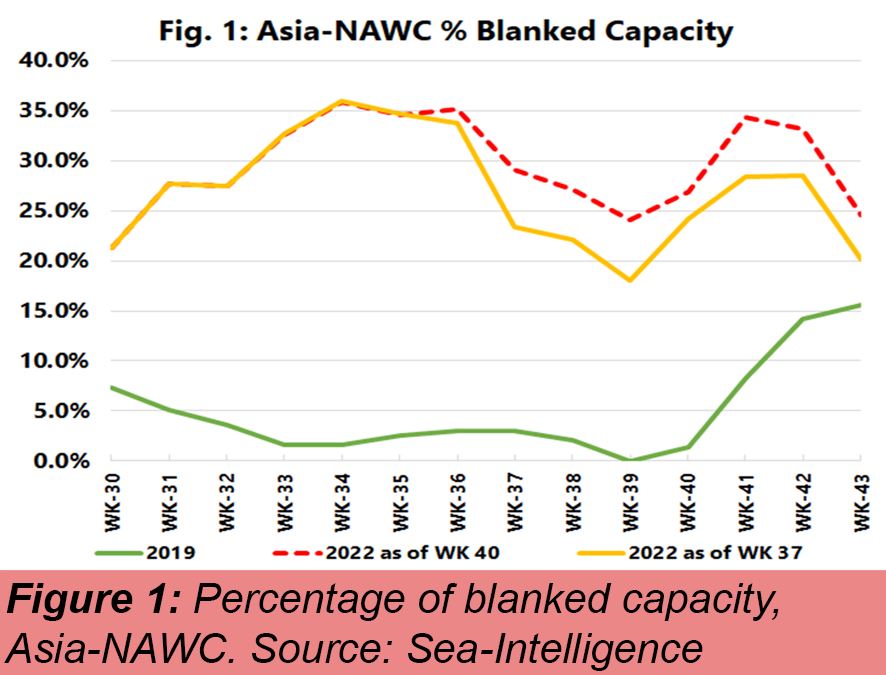

The level of blank capacity is already higher than in 2019 and has even increased from what was scheduled in the outlook from Week 37, Alan Murphy, CEO of Sea-Intelligence noted. He pointed out that in the weeks following Golden Week (weeks 41-43), carriers have taken out significant levels of capacity per week (see Figure 1).

An analysis of capacity on major trade routes shows an average of -26% to -31% reduction on the Trans-Pacific corridor over Weeks 41-43.

The average capacity reduction on the Asia-Europe corridor was between -19% to -27%. This is reflected in the reduced number of vessels arriving at the major ports in the U.S. and Europe.

The Marine Exchange of Southern California reports a lower than “normal” level of vessels scheduled to arrive, based on 2018/19 pre-COVID levels.

However, at Savannah on the U.S. East Coast, the backlog of containerships remains and in Northern Europe, congestion continues as a lingering effect in part from the strikes at German ports during June and July and the recent actions at Felixstowe and now Liverpool in the UK.

Murphy observed the current levels of capacity reductions have only brought underlying capacity in line with 2019 levels.

Asia-North America West Coast is scheduled to see capacity grow by 1.9% when annualized over 2019, while Asia-North America East Coast and Asia-North Europe will see even larger capacity increases of 3.1% and 5.1%, respectively. Only Asia-Mediterranean is contracting, by -1.3%.

“A more pertinent question then becomes whether carriers can really blank more capacity to try and control the freight rate drop,” Murphy said. Carriers have already returned to the range of 10 to 30% capacity reductions and a 50% reduction in deployed capacity will not only create significantly more supply chain problems but will also likely have the cargo owners “up in arms.”

Sea-Intelligence concludes that there is a very delicate balancing act for the carriers to follow going forward. The efforts to balance capacity will also become increasingly critical for the carriers as the markets are expected to see the introduction of the first of the newbuilds in 2023.

Source: Maritime Executive, Sea-Intelligence