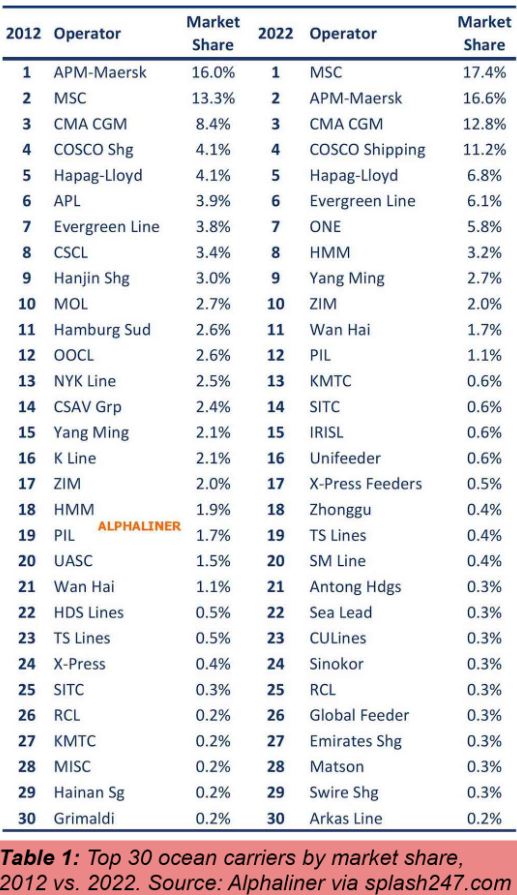

There is a substantial gap in fleet sizes between the leading carriers and the rest of the container field.

The top 10 container shipping lines operate 21.8 million TEU of capacity compared to the next 20 carriers which have a combined 2.5 million TEU of capacity, according to Alphaliner data.

Proportionally, larger shipping lines have also earned more during the pandemic.

Earnings for medium and small lines typically increased by between 100% and 700% between 2019 and 2021 whereas the top 10 carriers increased their profits by between 1,000% and nearly 6,000%, Alphaliner reported.

Olaf Merk, shipping expert at the OECD-affiliated think tank International Transport Forum (ITF), warned that such dominance has led to serious monopoly concerns.

“In well-functioning markets, new firms – price fighters – will emerge to provide alternatives to the high prices of the established firms.

In container shipping this does not seem to be happening.” Merk said the capacity of firms newly entering the container market is less than 0.5% of the total capacity.

Regulators and shippers are concerned with both the size of the global carriers as well as the nature of the global alliances. The three main global liner alliances account for more than 90% of all boxes shifted on the main East-West tradelanes.

Parash Jain, HSBC’s global head of shipping and ports research, noted ocean carriers’ strong positioning which has benefited from consolidation.

“Going forward, we argue that after years of consolidation and the formation of mega shipping alliances, the shipping lines have learnt the capacity discipline and while there might still be volatility in freight rates, the rock-bottom level of freight rates seen in the past decade might no longer persist in the future,” Jain said.

Source: splash247.com