Overall, China’s total container volumes have only seen a marginal contraction of 2.5% in April despite pandemic-related lockdowns in Shanghai.

Even though Shanghai port recorded a -25% drop in containers handled in April, much of that volume was redirected with seven of the ten largest container ports located in China, The McCown Report assessed.

Cargo volumes are unlikely to slow down anytime soon, says Mario Cordero, executive director of the Port of Long Beach, adding that the port is bracing for the peak season. “We are preparing for a likely summertime surge as China recovers from an extended shutdown due to COVID-19.”

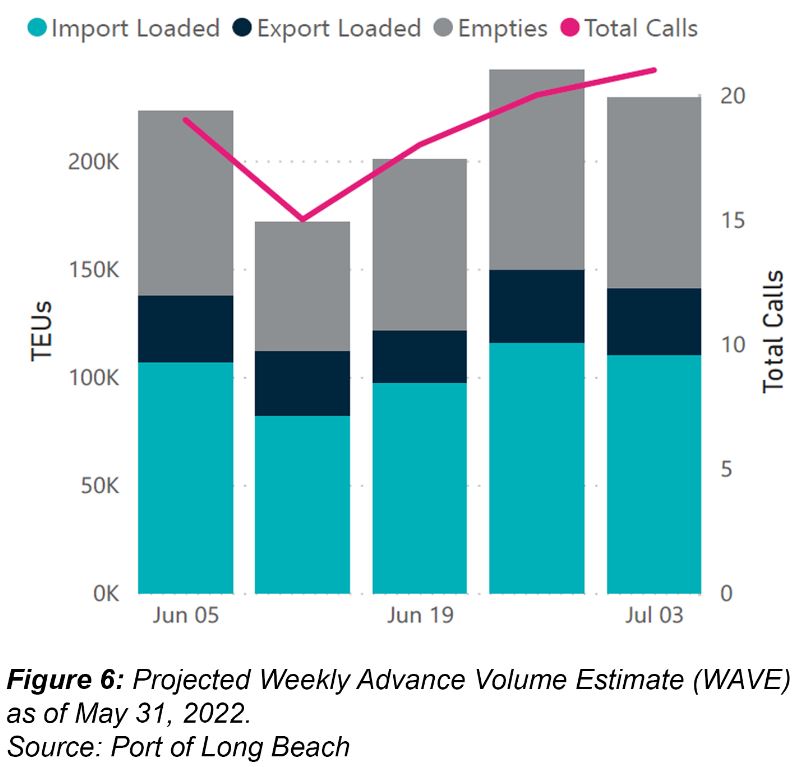

The port’s forward-looking Weekly Advance Volume Estimate (WAVE) report released on May 31st shows an upsurge of cargo container volumes and vessel calls through July 3rd

Mr. Cordero says even though operations at the port of Shanghai have been able to continue, transport into and out of the terminals has been badly affected.

“Consolidated cargo in Shanghai has been impacted greatly. While ports have been operating and drayage operators have been somewhat active in the region, the trucks delivering to warehouses were for a time severely curtailed, resulting in a buildup of LCL cargo.”

Maritime consultancy Drewry says an estimated 260,000 TEU was not shipped from Shanghai in the month of April. It anticipates the backlog of unshipped cargo will coincide with the summer peak season.

“The LCL cargo will likely start arriving in West Coast ports around the July 1 timeframe”.

Meanwhile congestion continues on U.S. West and East coasts with ships queuing for berths at multiple ports. In mid-May, the Marine Exchange of Southern California reported 29 ships waiting for berth off Los Angeles and Long Beach in while on U.S. East and Gulf Coasts, 45 vessels were waiting offshore.

Trans-Pacific carrier on-time performance to both U.S. coasts improved in March/April 2022 despite the vessel backlogs. Data by Sea-intelligence shows reliability at 21% on the Asia-North America West Coast trade and at 21.7% for the East Coast trade.

Average vessel delays on Asia-U.S. West Coast in March/April improved to 11.28 days but is still the highest recorded figure for the month and is higher by 0.44 days than a year ago. On the Asia-U.S. East Coast trade lane, average vessel delays decreased to 10.45 days but is the highest recorded figure for the month. On a y/y level, the delay measured 3.75 days higher than in 2021.

Border and infrastructure hurdles eliminate ports in Canada and Mexico as alternatives for many shippers. And while transporting cargo by air is an option, a surge in cargo volumes would overwhelm airport cargo facilities.

Global air cargo capacity despite increasing 1% y/y in April, remains at -13% below 2019 levels according to CLIVE Data Services.