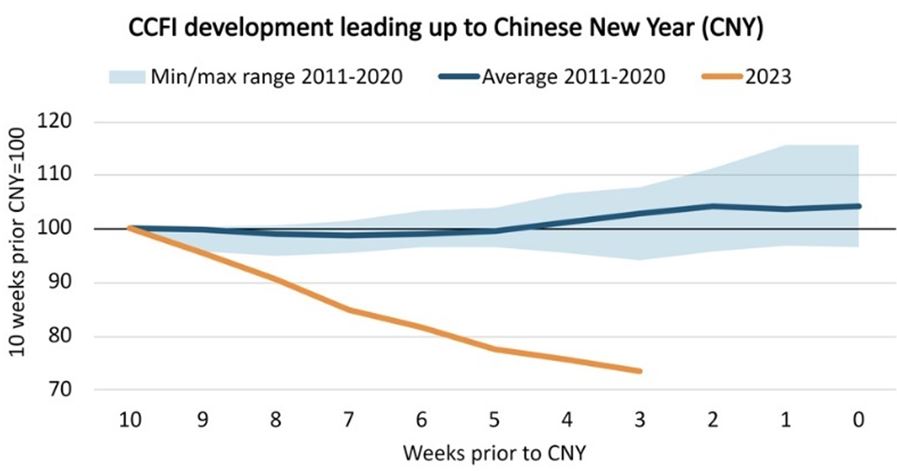

Chinese container exports which typically spike in the weeks leading up to Chinese New Year (CNY), faced a drop in prices and continues to downtrend, performing the worst in 13 years, according to chief shipping analyst at BIMCO, Niels Rasmussen.

“Spot rates for containers loading in Shanghai will normally be 12% higher just before CNY than ten weeks earlier.

Similarly, average rates for all containers loading in China will normally end 4% higher. This year, both spot and average rates, however, continue to fall,” said Rasmussen.

The China Containerized Freight Index (CCFI) which measures average container freight rates for exports out of China, has seen a 50% drop since February 2022.

In the lead up to CNY, it has continued to fall, dropping by a further 27% since mid-November.

“From 2011 to 2020, the CCFI on average increased 3% in the seven weeks from week 10 before CNY to week three before CNY.

The worst year was 2012 when the CCFI fell 6% during those seven weeks while the best year was 2020 with an 8% increase.

The market situation in 2021 and 2022 was unique as congestion and a spike in consumer demand led the market, and the lead-up to CNY was also strong.

So far, the development in 2023 is therefore the worst in thirteen years,” Nielsen commented.

For exports to Europe and the Mediterranean, the CCFI has fallen by 34% and 57% respectively during the last seven weeks, while exports for the U.S. West and East Coast are down by 26% and 27% respectively.

“During the last seven weeks, the CCFI has also dropped faster than spot rates for exports out of Shanghai (as recorded by the Shanghai Containerized Freight Index – SCFI).

The SCFI has fallen 23% whereas the CCFI has fallen 27%,” noted Rasmussen.

Source: BIMCO