Chinese exporters displaying their products at the largest trade fair in the country have expressed concern that their businesses are being impacted by the weak global economy.

Some have even frozen investments and reduced labor costs in response.

The subdued mood at the Canton Fair in Guangzhou suggests that China’s unexpected surge in exports in March may have been due to exporters catching up with delayed orders from last year rather than a renewed economic strength.

This comes as borrowing costs in the US and Europe have risen sharply, leading to a decrease in demand for Chinese-made goods.

Kris Lin, a representative from Christmas light producer Taizhou Hangjie Lamps, has said that this year’s orders are down 30% from last year due to both internal and external issues.

Higher electricity costs resulting from the war in Ukraine have also led to a reduction in demand for the company’s decorations.

Huang Qinqin, sales director at Zhong Shan Shi Limaton Electronics, has expressed similar thoughts on cutting costs after orders halved in the first quarter.

The company’s workers used to work overtime even on weekends, but it has become more common for them to take weekends off this year.

The outlook for workers in the manufacturing industry is concerning, as policymakers aim to create 12 million new jobs across China this year.

However, dozens of Chinese suppliers have stated that they do not intend to spend much on improving production lines this year due to weak demand.

Vicky Chen, foreign trade manager at socket producer Qinjia Electric, does not expect a significant sales boost at the fair, which runs until May 5.

“The whole global economy is fairing poorly at the moment, and the fair won’t change that,” she said.

China’s Q1 GDP growth seen rebounding to 4.0%, 2023 rate seen at 5.4%: Reuters poll

China Q1 GDP seen growing 4.0% y/y, vs 2.9% in Q4

GDP growth seen at 5.4% in 2023, 5.0% in 2024

Inflation seen at 2.3% in 2023, 2.3% in 2024

Central Bank seen keeping key lending rates unchanged until end-2023

Newly released data indicates that China’s economy is experiencing a gradual but inconsistent recovery, with consumption, services, and infrastructure leading the way.

However, decelerating inflation and a surge in bank savings have raised concerns about the strength of the recovery in domestic demand.

Zhang Yiping, an economist at China Merchants Securities in Shenzhen, explained that although domestic demand is improving, the recovery is not strong enough.

Policymakers have pledged to provide more support to the world’s second-largest economy, which is bouncing back following the abrupt lifting of COVID-19 restrictions in December.

The government has set a modest growth target of around 5% for this year, after failing to meet its goal for 2022.

According to a Reuters poll, growth is expected to moderate to 5.0% in 2024.

Uneven Economic Recovery Raises Doubts Over Strength of Pick-up in Domestic Demand

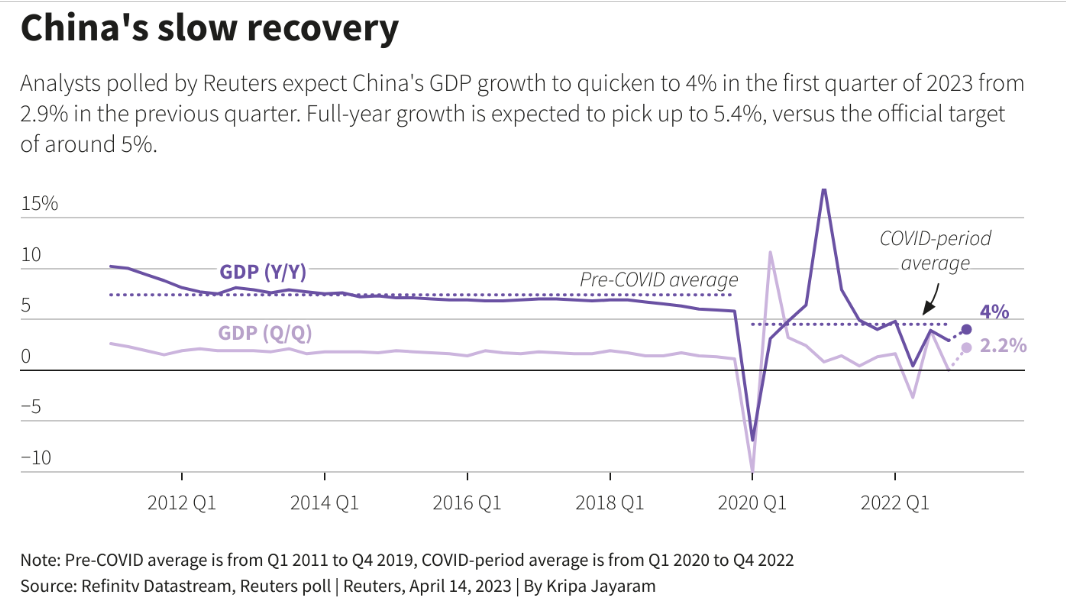

China’s gross domestic product likely perked up in the first quarter of the year, a Reuters poll showed on Friday, as the end of strict COVID-19 curbs helped lift the world’s second-largest economy out of a crippling pandemic slump. GDP growth was seen speeding up to 4.0% in the first quarter from a year earlier, from 2.9% in the previous three months, according to the median forecast of 70 economists polled by Reuters. That would be the fastest growth since the first quarter of last year. For 2023, growth was expected to pick up to 5.4%, the poll showed, from 3.0% last year – one of its worst performances in nearly half a century due to strict COVID-19 curbs.

According to recent data, China’s exports unexpectedly surged in March. However, analysts are cautioning that the improvement partly reflects suppliers catching up with unfulfilled orders after last year’s COVID-19 disruptions. New bank lending also hit an all-time high in the first quarter, but consumer inflation slipped to an 18-month low, and factory-gate deflation deepened in March, increasing the likelihood for more easing to inject momentum into the economic recovery. “ID policy shift on consumption and investment, including stronger than expected exports,” said Zhang Yiping, an economist at China Merchants Securities in Shenzhen.

In the first quarter alone, households added a staggering 9.9 trillion yuan in bank deposits, more than half the 17.8 trillion yuan for the whole of 2022. According to a poll, the economy is forecast to grow 2.2% in January-March on a quarterly basis, compared with no change in October-December. To support the growth, policymakers will rely on a mix of modest monetary easing and infrastructure spending, alongside efforts to bolster the property sector. The central bank has pledged to make its policy “precise and forceful” this year to support the economy, keeping liquidity reasonably ample, and lowering funding costs for businesses.

Analysts polled by Reuters expect the central bank to keep the benchmark lending rate – the one-year loan prime rate (LPR) and banks’ reserve requirement ratio (RRR) – until the end of 2023. However, some analysts believe the central bank could deliver a small cut in the LPR in the coming weeks if inflation slows further. The central bank, which cut the RRR in March, has kept the benchmark lending rates since September. “We need to maintain the stability and continuity of macro policies to consolidate the economic recovery,” said Wen Bin, chief economist at China Minsheng Bank. “There is still room for cutting RRR, but a cut in the near term is unlikely.” The poll showed that consumer inflation would likely quicken to 2.3% in 2023 from 2.0% in 2022 before steadying in 2024.

Source: Reuters