International trade growth will not match the global economic pace over most of the next decade, according to a new report by the Boston Consulting Group (BCG).

Trade patters will change even as the war in Ukraine is reshaping strategic alliances and altering the flow of cross-border commerce.

World trade’s annual expansion rate will average 2.3% through 2031, compared with an increase in the global gross domestic product of 2.5% on average each year over the same period, according to forecasts from BCG.

Nikolaus Lang, a BCG managing director and a co-author of the report noted that four major supply chains – energy, agriculture, industrial metals, and semiconductors, account for about 80% of current inflationary price pressures.

BCG outlined that the next nine years of trade upheaval will create the following winners and losers:

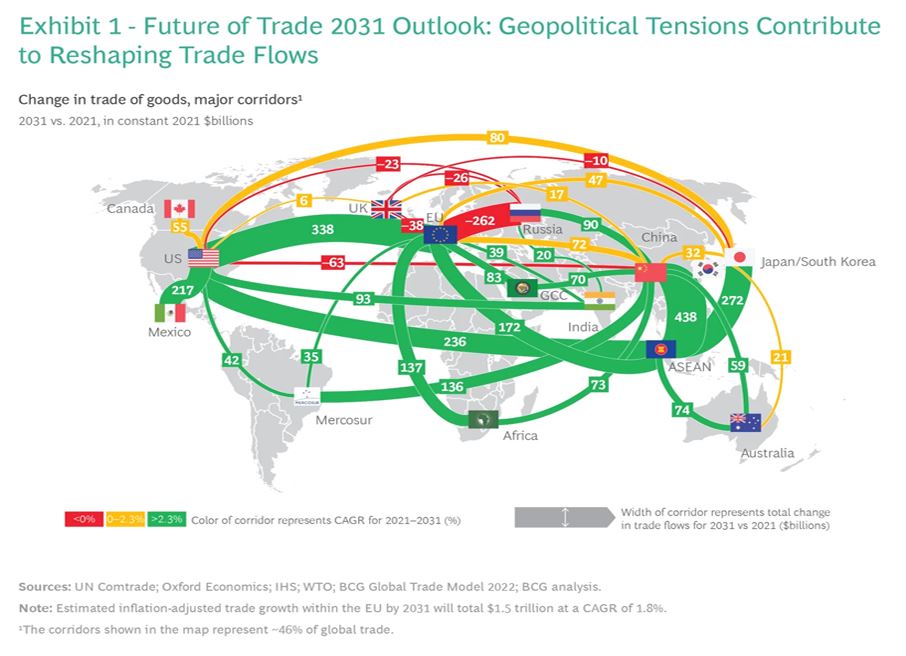

- The European Union will boost its trade with the U.S. by $338 billion, primarily driven by American energy exports to Europe.

It will also expand its combined trade with Asian countries, Africa, the Middle East, and India. - Trade between the U.S. and China will drop by $63 billion.

- Trade growth will also decelerate between the EU and China, growing by $72 billion, which BCG called “a modest increase compared with previous years.”

- Russia’s trade with China and India will grow by $110 billion, “including $90 billion with China alone”, the consultancy said.

- Southeast Asia will be the main winner, with an estimated $1 trillion in new trade tied largely to new commerce with China, Japan, the U.S., and the EU.

- ASEAN trade with China will grow by $438 billion, the largest interregional progress.

Source: American Journal of Transportation