Sea-Intelligence studied the effects of capacity removal due to vessel scheduling delays and assessed what it meant for the growth in the global fleet and its impact on the global supply and demand balance.

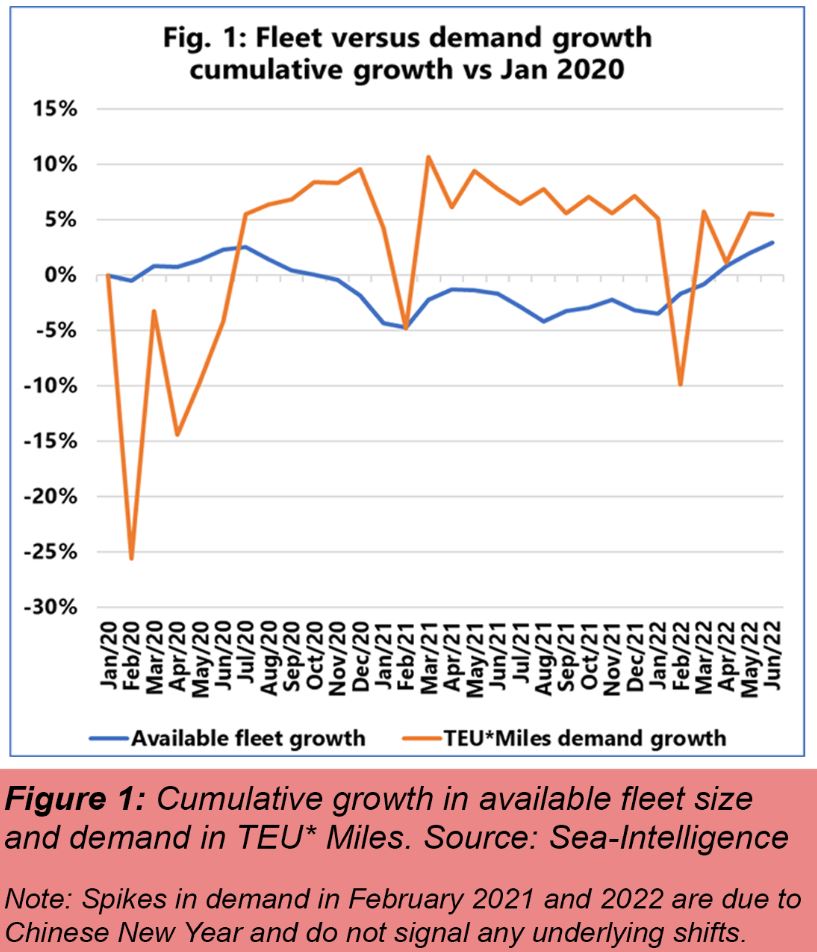

The report found that while the nominal fleet grew at a steady rate of roughly 4% year-on-year in 2020-2022, there was a substantial decline in the available fleet growth as delays began to worsen.

Extreme strength in favor of the carriers in 2021 has been driven by a consistently high demand growth compared to the available fleet.

The imbalance in demand and supply has only begun to taper off in recent months, Alan Murphy, CEO at Sea-intelligence noted.

Demand was consistently 10% higher than capacity from November 2020 to January 2022 but has since narrowed down to 2% versus the pre-pandemic levels.

“All in all, what the data shows is that the extreme spikes in freight rates in 2021 were indeed driven by a situation where demand suddenly exceeded capacity at a global level, primarily driven by the unavailability of capacity.

The recent trend towards normalization has in turn also been primarily driven by gradual improvements in schedule reliability and vessel delays, and as long as improvements continue, we should expect that the supply/demand balance

will also continue to decline, and freight rates will be under increasing downwards pressure,” Murphy summarized.

Source: Sea-Intelligence