Air cargo revenues have doubled over pre-pandemic levels, marking 2022 as one of the industry’s strongest years ever the International Air Transport Association (IATA) said. Air cargo is expected to continue supporting the industry’s performance. Volumes are projected to rise this year even as cargo yield moderates with the additional belly capacity from passenger aircraft returning to service.

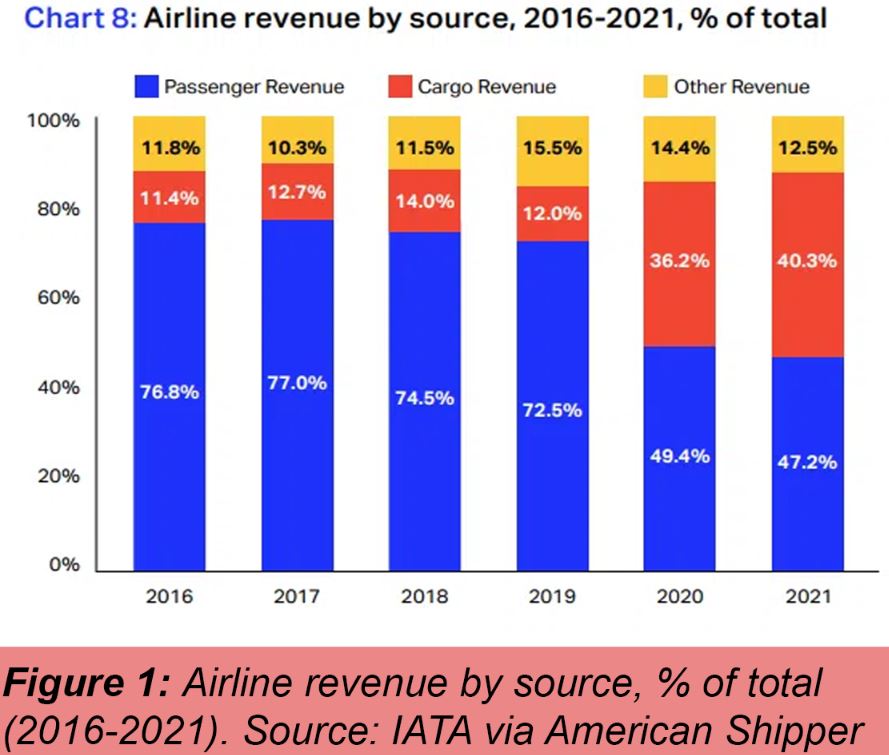

IATA Director General Willie Walsh said in opening remarks to the group annual general meeting in Doha, Qatar, “Cargo is performing well against a backdrop of growing economic uncertainty.” Cargo revenues are expected to tally $191 billion, a 6.4% reduction from 2021’s peak of $204 billion and nearly twice the $100 billion achieved in 2019. Airfreight will account for 24.4% of total passenger and cargo airline sales, IATA estimated. With passenger traffic decimated by the pandemic, cargo represented 36.2% and 40.3% of airline revenues in 2020 and 2021, respectively, compared to about 12% in the preceding four years (see Figure 1).

Airlines are projected to carry more than 75 million tons this year, which would represent a record high even as growth has flattened on a seasonally adjusted basis. IATA is projecting air cargo volumes to be 11.7% above the pre-pandemic level following 2021 growth of 6.9% versus 2019.

Global merchandise trade growth is expected to moderate to 3% this year, according to the World Trade Organization. IATA forecasts the value of international trade shipped by air this year to be about $8.2 trillion, up from $7.5 trillion in 2021, as inflation increases the cost of goods.

Marie Owens Thomsen, IATA’s chief economist, last month estimated a 20% chance for a recession next year but said economic activity and air cargo would still be relatively solid in 2022. Softer market conditions are expected to knock down cargo yields by 10.4% from last year, IATA predicted. That is a small retreat for per-unit profits but doesn’t undo the increases of 52.5% in 2020 and 24.2% in 2021. Yields are being propped up by strong shipping demand combined with 5% to 10% less cargo capacity, and airline surcharges for recovering extra fuel expenses.

The guidance suggests the air cargo market is poised for a very strong third quarter that makes up for the slow start to the year. IATA’s projections are matching up with with feedback from air logistics providers that say they expect an early peak season this year as companies rush to expedite delivery of shipments that were backlogged in China because of quarantine edicts that limited factory, port and airport operations in major cities.

Source: American Shipper