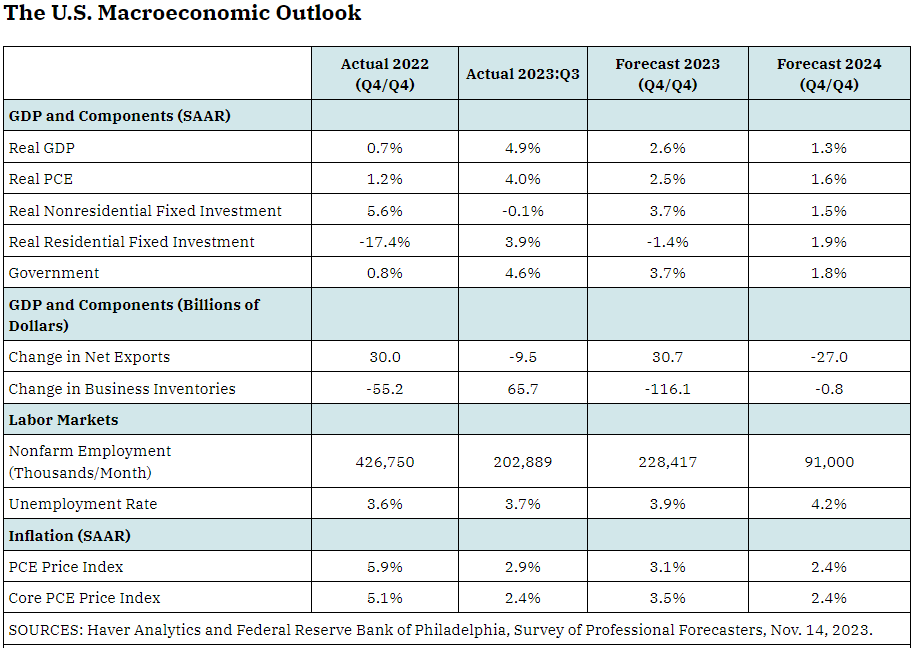

The U.S. economy is expected to slow in 2024, with real GDP growth projected to fall to 1.3% from 2.6% in 2023. Private forecasters also expect inflation to continue to decline, falling to 2.4% in 2024.

Key factors contributing to the slowdown in 2024 include:

- Slower growth of real private consumption expenditures (PCE): PCE is the largest component of real GDP, and forecasters expect growth to slow from 2.5% in 2023 to 1.6% in 2024.

- Slower growth of nonresidential fixed investment: Nonresidential fixed investment is a key indicator of business sentiment, and capital spending is a key contributor to future estimates of real potential GDP. Forecasters expect real nonresidential fixed investment to slow from 3.7% in 2023 to 1.5% in 2024.

- Slower growth of government expenditures: Private forecasters expect the growth of government expenditures to slow to 1.8% in 2024, about half the pace expected in 2023.

Despite the slowdown, the U.S. economy is expected to avoid a recession in 2024.

- Labor market: Nonfarm payroll employment is projected to slow from an average of 228,417 jobs per month in 2023 to 91,000 jobs per month in 2024. The unemployment rate is forecast to slowly drift upward to an average of 4.2% in 2024, 0.5 percentage points more than its average in the third quarter of 2023.

- Inflation: The expectation of below-trend real GDP growth in 2024 results in forecasts for slower—but still positive—job growth and a modest increase in the unemployment rate. In the September 2023 SEP, the median FOMC participant projected that headline and core PCE price index inflation would continue to decline in 2024 and eventually drop below 3%. Private forecasters concur with this outlook; headline and core inflation are forecast to fall to 2.4% in 2024.

Risks to the outlook:

- Monetary policy: The risk of recession likely reflects many factors. The first is whether the Fed’s current monetary policy stance (i.e., the level of the real federal funds rate target range) is high enough to bring inflation back to 2% in a timely manner.

- Geopolitical risks: Second, geopolitical risks abound. For instance, wars are being fought in the Middle East and Eastern Europe—both large oil-producing regions.

- Financial instability: Third, there are concerns about what rising interest rates in 2023 could imply for default and delinquency rates across several loan categories.

Overall, the U.S. economic outlook for 2024 is for slower growth but no recession. Inflation is expected to continue to decline, but the risk of recession remains elevated.

Source: www.stlouisfed.org