General airfreight spot rates fell -9% year-on-year in September, below the 2021 level for the first time this year, as growing global cargo capacity continues to outpace air cargo volumes, CLIVE Data Services reported.

Niall van de Wouw, chief airfreight officer at Xeneta said there are “no indications” demand will increase again. He noted some air cargo business will likely shift back to ocean as congestion eases in the ocean freight market

Overall, global air cargo demand in September, measured in chargeable weight, remained a negative trend, falling -5% from last year.

The demand downturn is accompanied by a 5% recovery in global cargo capacity.

It remained just -7% below pre-pandemic levels. CLIVE’s ‘dynamic load factor’ which measures both weight and volumes, giving indications of how full planes are, reflected the trend of declining demand and increasing capacity.

It fell -7% pts lower over the same month last year to 59% and was 2% pts adrift of the level recorded in September 2019.

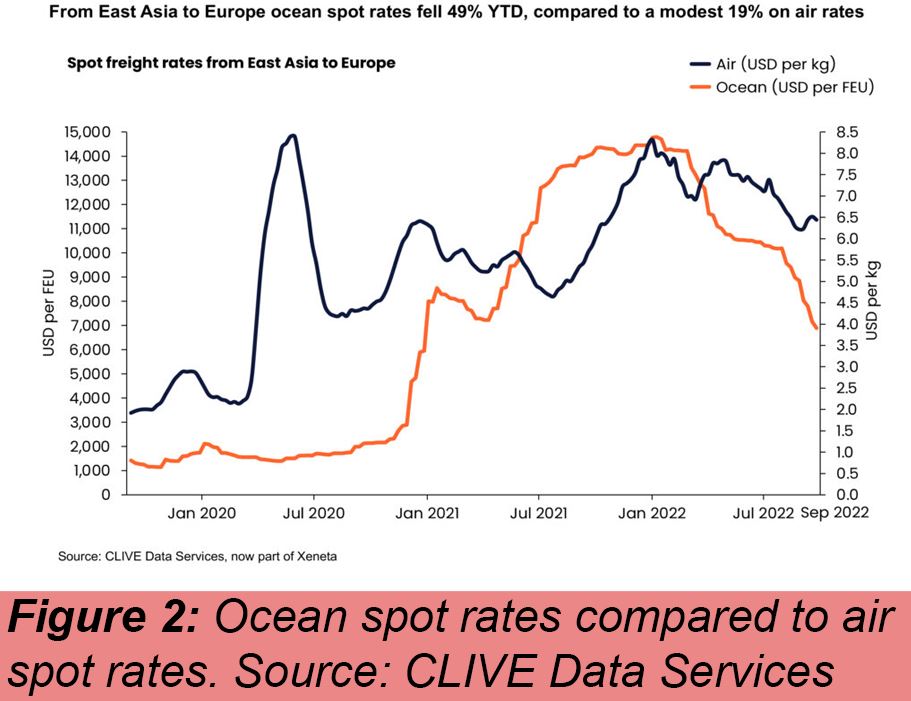

In September, ocean spot rates from East Asia to Europe fell -49% from January levels, while air freight spot rates were -19% lower (see Figure).

CLIVE pointed out the market will be strongly influenced by returning air cargo capacity.

“What we see is a very ‘jumpy’ air cargo market which responds very quickly to global events, whether this is the escalation of the conflict in Ukraine, rising inflation, the pressure on Sterling, or the stronger U.S. dollar,” said van de Wouw.

“We see a flat air cargo market in terms of demand, but the fall in general airfreight rates and load factor are likely to be exacerbated by the continuing return of capacity, even as we head towards a winter season when, traditionally, we would expect to see cargo space in the prime Europe and North America markets cut back.

Shippers who have held their nerve and not shipped their peak season goods early by air are likely to find themselves in a stronger buying position,” he added.

Source: Air Cargo News