Spot container shipping rates between Asia and the U.S. have been increasing by double digits in July, climbing for three consecutive weeks, reaching levels similar to early 2023 and late 2022.

Meanwhile, shipping lines have become more disciplined at managing vessel capacity. “Typically, higher demand leads to higher capacity availability, but over the past month, liners have focused on tightening service offerings as demand has improved,” said Omar Nokta, shipping analyst at investment bank Jefferies.

Platts said capacity constraints and limited space availability mean shippers have to book space earlier.

Spot rates are expected to continue rising in August. The company said a logistics source noted Asia-West Coast capacity is down -15% this month versus June, while Asia-East Coast capacity is down -8% to -10%, including the effect of Panama Canal restrictions.

Drewry said rising Trans-Pacific spot rates stem from factors such as canceled sailings, labor disruptions in British Columbia and a more positive outlook for cargo demand in North America.

Linerlytica highlighted the differing trends in the Trans-Pacific and Asia-Europe trades. Many newbuildings being delivered this year are ships with capacity of 24,000 twenty-foot equivalent units designed for Asia-Europe service. With the capacity influx, rates are falling. Conversely, less capacity is being added to the Asia-U.S. market, resulting in rising rates.

Trans-Pacific deployments are down -12.1% to date, while Asia-Europe capacity is up 7.6%. “Further divergence [is] expected in the coming months as even more capacity is added to Europe while capacity is withdrawn from the Trans-Pacific market,” said Linerlytica.

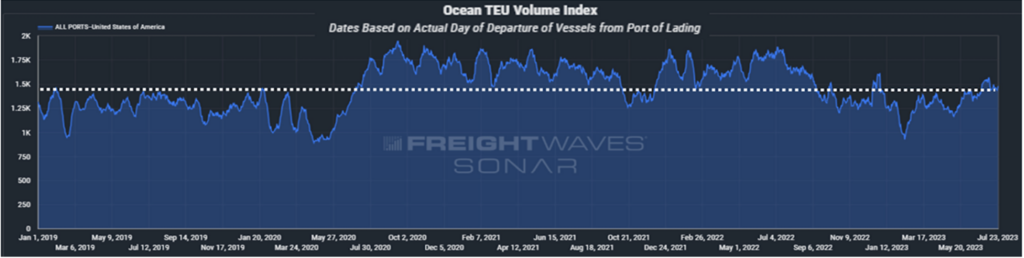

Bookings data from FreightWaves SONAR’s Container Atlas implies U.S. imports should remain at healthy levels through August and into the first half of September (see Figure 1).