Several shipping liner executives predicted a gradual decline in spot container rates levels during their latest quarterly calls.

Maersk CFO Patrik Jany said it would be a “progressive erosion” not “a one-day drop”, while Matson CEO Matt Cox noted rates were “adjusting slowly” and not “falling off a cliff”.

Yet, container spot rates appear to be plummeting more rapidly than expected.

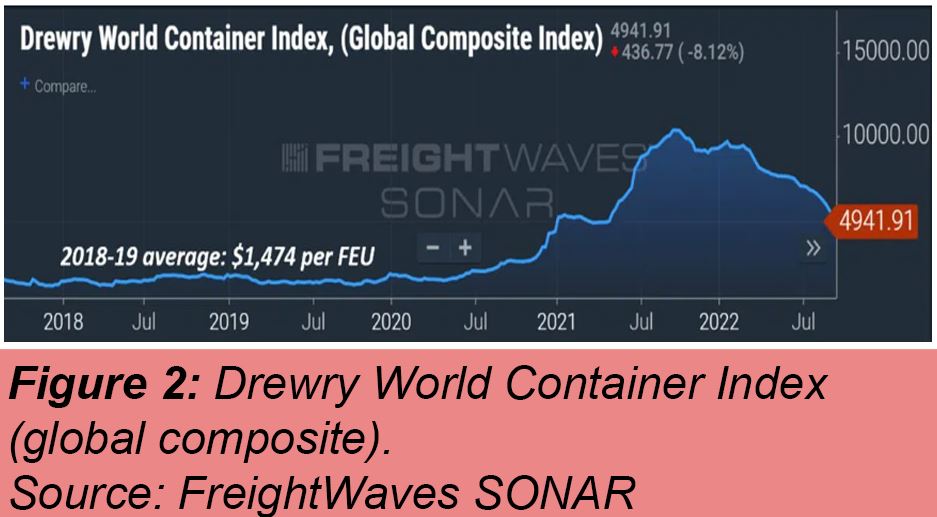

The steepest declines have taken place in the Asia-West Coast market.

The Freightos Baltic Daily Index (FBX) China-West Coast assessment has fallen -76% over the past six months while the Drewry Shanghai-Los Angeles assessment is down -57% in the same period.

“There is no clarity with respect to when or where market rates may bottom,” said Stifel analyst Ben Nolan.

When import demand plummeted in the second quarter of 2020 due to pandemic lockdowns in Europe and the U.S., ocean carriers blanked sailings, reducing capacity and stopped the spot-rate slide.

Sources have told Platts China’s Golden Week holiday (Oct. 1-7) could be a potential turning point. “Most sources expect the period immediately after Golden Week to be marked by a tonnage reshuffling as carriers look to balance capacity against the evolving marketplace,” reported Platts.

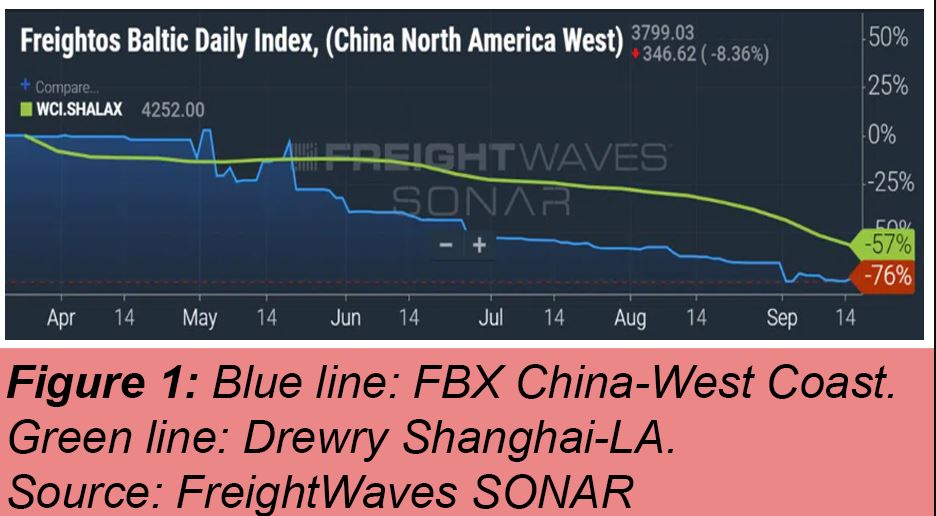

Drewry’s global index, despite being down -44% over past 6 months, is still 3.4 times the pre-COVID average.

If this same pace of decline were to continue, the Drewry global index would not reach pre-COVID levels until mid-Q1 2023.

If the same pace of decline continued for the next three months, the index would still be double pre-COVID levels.

As ocean carriers now have more volume on annual contracts, the spot rate decline alone will not have the same effect as it did pre-pandemic.

Furthermore, contract rates are dramatically higher than they used to be.

According to Xeneta’s global index which tracks long-term freight rates is approximately 4.5 times above pre-COVID levels in August and up 121% year-on-year.

Source: American Shipper