The January inflation rate was slightly higher than expected, with the government reporting a 0.5% increase compared to economists’ expectation of a 0.4% increase.

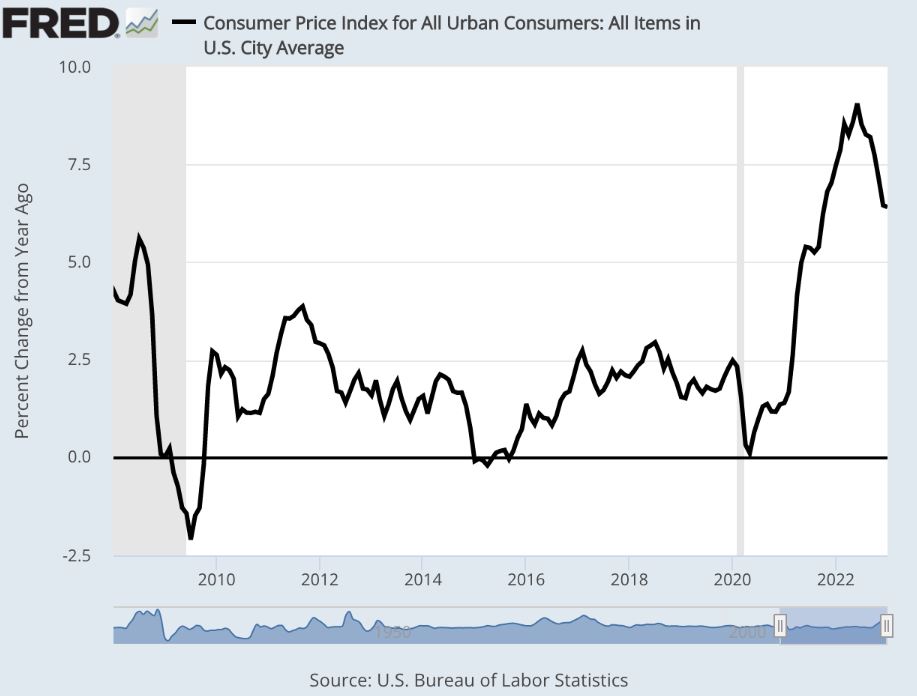

In the past year, inflation has risen by 6.4%, which is 0.2% higher than expected.

The core rate, which excludes food and energy prices, rose by 0.4% in January, which was 0.1% higher than expected, and over the past 12 months, it has increased by 5.6%.

Rising shelter costs accounted for about half of the monthly increase, and energy and food costs also contributed significantly.

The report also showed that average hourly earnings fell 0.2% for the month and were down 1.8% from a year ago, leading to a loss in real pay for workers.

While inflation has been fading, it’s taking its time, and the battle to beat it won’t be a quick one.

The report had a significant impact on futures traders, who now expect the Fed to be more aggressive with its interest rate hikes.

There is a high probability of a 0.25% rate hike next month and another one in May, and traders also see an additional rate hike coming in June, which was not previously expected.

However, traders anticipate a rate cut by December.

The International Monetary Fund has raised its estimate for U.S. economic growth this year to 1.4%, which is better than a recession.

The report gives the Fed more cover to keep raising interest rates, and the idea that the economy is about to tip over into a recession seems less likely.