A slowdown in production typically takes place in the period around the Chinese Lunar New Year (CNY) with shipping lines blanking sailings to balance supply with demand.

Yet, despite a market faced with stagnated demand growth and declining freight rates, carriers have not acted to reduce additional capacity during CNY 2023.

Sea-Intelligence data shows the opposite is taking place.

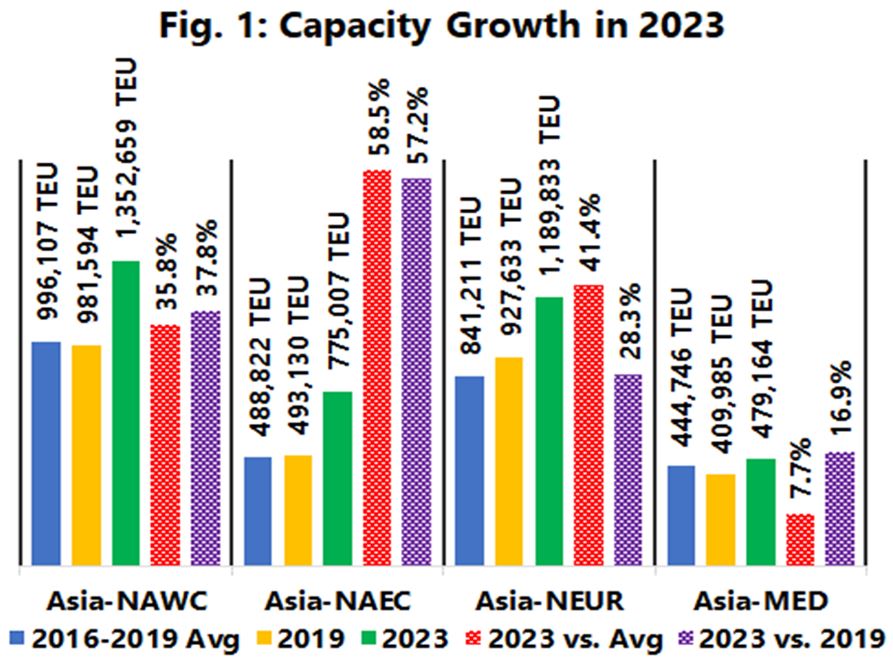

When comparing 2023 with both 2019 and the average capacity growth rate of 2015-2019, there is an increase in deployed capacity.

“Asia-North America West Coast is seeing capacity growth of 35%-38%, Asia-North America East Coast of a staggering 57%-59%, and Asia-North Europe of 28%-42%.

Asia-Mediterranean is the only trade lane that is closer to the pre-pandemic levels,” said Alan Murphy, CEO of Sea-Intelligence.

Sea-Intelligence warns the capacity reductions may not come quickly enough, setting the stage for even more price competition as volumes decline during and after the Chinese New Year.

“Despite falling demand, deployed capacity during CNY 2023 is slated to be higher than the deployed capacity in 2021, where demand was absolutely surging.

If demand continues to be sluggish, or outright contracts, given these capacity levels, freight rates will continue to tumble,” said Murphy.

“With the shipping lines sitting on piles of cash, further helped by a highly profitable Q3, we might end up in a situation where there is another price war, reminiscent of the one we saw in 2015-2016,” he warned.

Source: Sea-Intelligence